Full disclosure: I use Kubera and love it enough to write this deep-dive. I get $100 in subscription credits through their referral program (and so do you!) if you sign up through links in this post and reply to their welcome email with my referral, but that's not why I'm writing this. I genuinely believe Kubera is the best solution for complex net worth tracking, and most people haven't heard of it. Consider this my public service announcement.

Early in my career, like any good fintech nerd needing to manage cashflow, I turned to personal finance management tools (PFMs) for the solution. What I didn’t realize is that my journey through PFM tools was the path we all take as we ascend the Over-Engineered Hierarchy of PFM Needs:

Level 1: The Budget Trackers

Level 2: The Money Managers

Level 3: The Wealth Platforms

Level 4: The Net Worth Dashboard

Level 1: The Budget Trackers

At this stage, I cared most about wrangling my spend into understandable reporting and finding opportunities to save money to enjoy my weekends and time away.

That’s where the Budget Trackers come in. I tried them all, from Mint as the OG budget tracking tool, to YNAB’s overly spreadsheet-driven approach, to Truebill (now Rocket Money)’s subscription management solution. Since my time at Level 1, I also tried new entrants like the beautiful Copilot and the re-imagined Mint as Simplifi. And there are so many more...

Copilot Money Panels

They primarily focus on your income and day-to-day expenses from your main bank account and credit cards. They provide a clear picture of your monthly cashflow so you can see if you’re spending more or less than you can afford.

Ultimately, I discovered too late that budget trackers should only be used for two major things:

Finding subscription sprawl: I found Rocket Money most effective at combating subscription sprawl. It has great auto-detection of existing subscriptions, a subscription calendar, and the ability to have the tool cancel subscriptions for you.

Quarterly spend reviews: Rocket Money and Copilot excel in categorizing spend to identify causes of spend creep and adjust lifestyle.

Rocket Money’s Subscription Tools

That’s it.

Diligently tracking my daily expenses and categorizing every item that passed my labyrinth of rules didn’t make sense. It wasn’t worth my time to sync accounts when they were out of sync (which happened troublingly often), re-categorize transactions, and update rules and filters.

The brutal truth is that after $100K in annual salary, budget tracking doesn’t make sense. Assuming your total take-home gets shaved by 25% for taxes, that’s $75K. Factor in your rent ($3K) and utilities ($150), and you’re down to ~$35K. With non-discretionary essentials like groceries, transit, and basic essentials, you’re left with ~60% of that or about $20K of discretionary spend. But only the portion of spend on negotiable expenses would benefit from budget tracking, unless you’re looking to reduce your lifestyle enjoyment, which means at most ~50% in the dining/bars, subscriptions, shopping, fitness bucket is negotiable/optimizable. Of that $10K, a budget tracker might get you 5-10% savings, one time (it’s hard to keep finding savings unless you have major lifestyle creep). So after all that work, you might have saved $500 - $1000.

Or, you could set aside 10% of your paycheck to a pre-tax 401(k) which grows at 10% per year in any diversified investment strategy. Without optimizing anything else, you would generate $1K+ per year in investment gains. This is much simpler, requires less mental overhead, and you still end up better off.

After a few years in tech, it’s time to graduate from Level 1 to Level 2 - the Money Managers.

Level 2: The Money Managers

Money Managers expand beyond your checking account and credit cards. They pull in your public investment accounts, joint accounts, auto loans, personal loans, and provide a complete financial picture. They offer planning tools, basic tax optimization insights, and help you think strategically about your finances.

The breadth is valuable when your financial life expands. Instead of asking "am I spending too much on coffee?", you're looking at:

How are my investments performing across accounts?

What's my total debt situation, including non-credit card loans?

How do joint accounts factor into our combined finances?

Are my investments tax-optimized across accounts?

The names you’ve heard are Monarch Money (useful but expensive) and Personal Capital (great until acquisition). These tools do everything in Level 1 and tackle other parts of your financial life. They also provide a clearer understanding of your financial trajectory and aspects of your overall wealth.

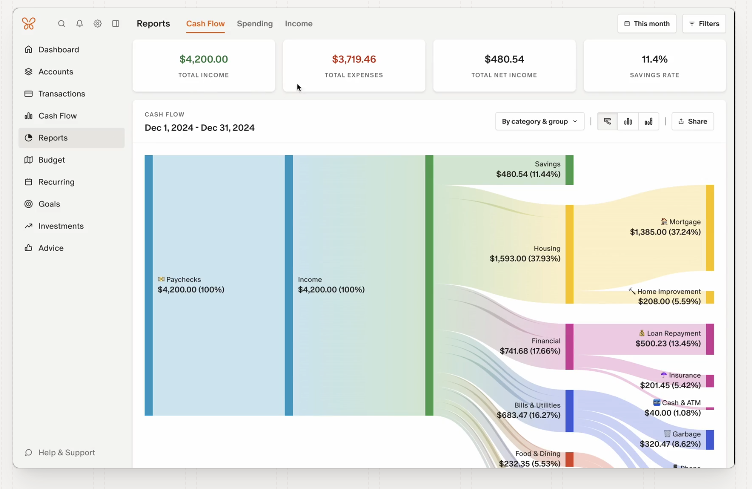

Monarch Money Cash Flow Tracker

But there are clear drawbacks. Investment tracking works for public markets through traditional brokerages, but it doesn’t always cover crypto and alternative investments. Key assets like your first house or car often need manual tracking. Planning is a good start, but if you’re trying to go beyond saving for specific goals to thinking more holistically about your financial goals, these tools don’t have all the answers. And while tax optimization is useful, you’ll still need to file on your own. They also have the same issues with syncing, maintenance, and comprehensiveness as some L1 offerings.

As you continue to achieve, your next level up is Level 3 - The Wealth Managers.

Level 3: The Wealth Platforms

At first glance, Wealth Platforms seem like the final evolution. Companies like Origin, Fifr, Range, SoFi, Wealthfront, and Compound aim to be your all-in-one solution. They do everything Level 1 and 2 tools do, plus advanced planning and analytics, dedicated investing portals, tax filing, and platforms that combine tech, AI, and human advisory.

Each carves out their niche: Origin excels at trust and will services, SoFi brings lending expertise, Wealthfront offers sophisticated robo-advisory, Range provides direct indexing, Fifr automates money movements, and Compound opens access to alternative investments. This feels like the top of the pyramid. Everything in one place, comprehensive service, what else could you want?

But here's the thing: once you reach a certain level of wealth, the all-in-one approach becomes a limitation, not a feature. What you need is simpler but harder to find: a robust net worth tracker that connects to everything, handles any type of asset or debt, and gives insights on your direction. A tool that doesn't try to do everything, but excels at showing you everything.

That's when you graduate beyond the pyramid to Level 4: The Net Worth Dashboard.

Level 4: The Net Worth Dashboard

The final evolution isn't about finding an all-in-one tool. It's about accepting the best-of-breed solution for every aspect of your financial life. I use Robinhood for brokerage, retirement & credit cards, Mercury for banking, Rivet for tax advisory & estate planning. This is the real pinnacle of the hierarchy - not trying to do everything suboptimally, but excelling at the one thing you need: seeing your complete financial picture to make better decisions about specialized tools for each aspect of your wealth.

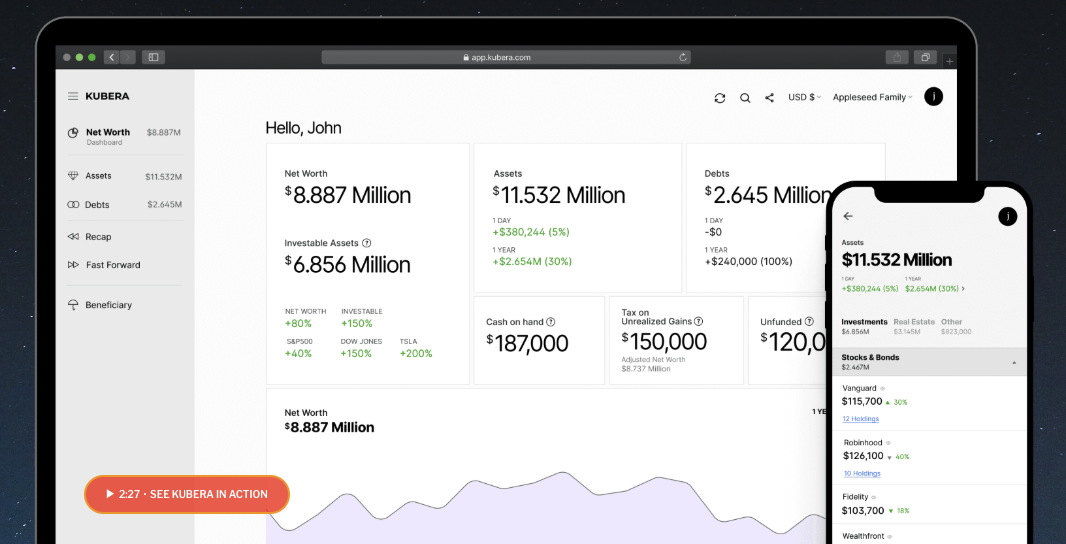

At this level, you need a powerful dashboard that can track everything without attempting to do everything. That's where Kubera comes in.

Kubera Net Worth Dashboard

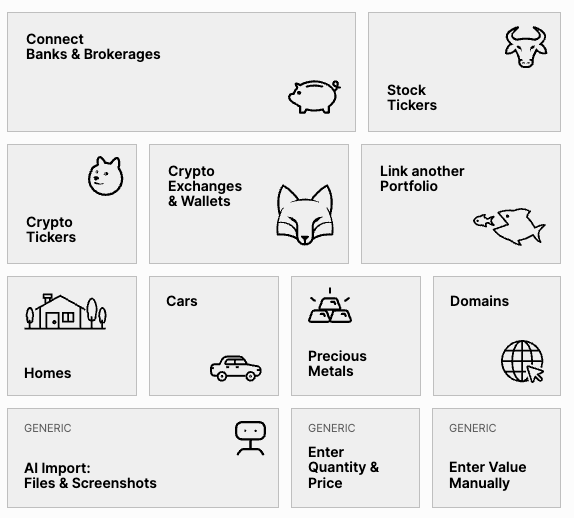

First, it has the most complete asset tracking I've seen. Beyond just pulling in traditional investment accounts, Kubera connects to 150+ crypto exchanges, wallets, and DeFi protocols, integrates with data providers for real estate valuations, includes VIN lookups for vehicles, stock options via Carta, private equity and VC investments, and even tracks things other tools ignore like internet domains. If it has value, Kubera can track it.

Kubera’s connections are infinite

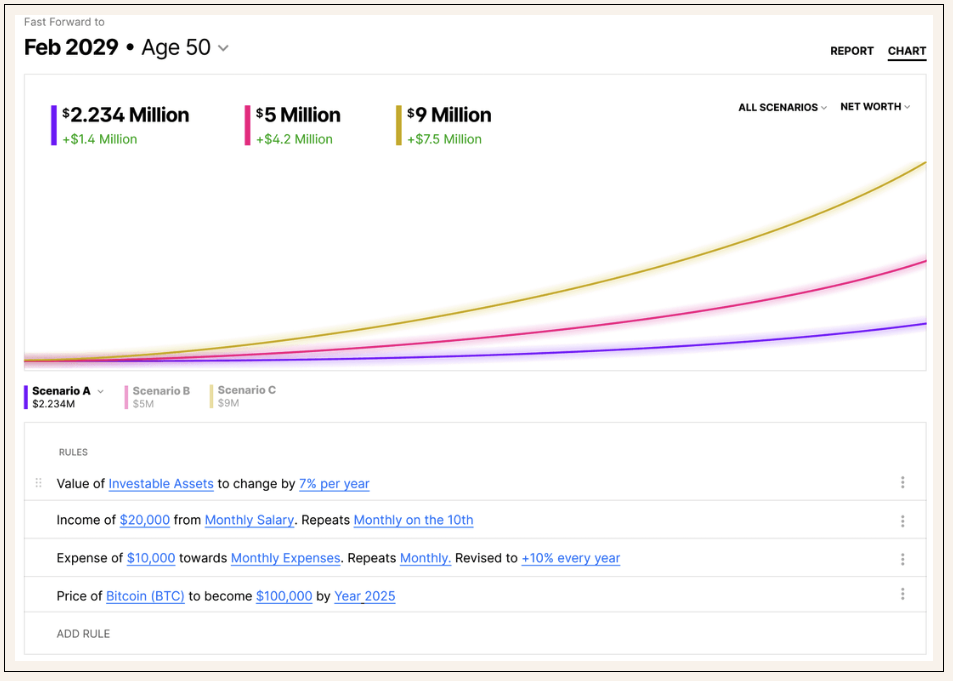

The analytics are equally comprehensive. You can model net worth scenarios through retirement, break down asset allocation across platforms, and track performance by asset type over time. I’ve tried every company’s version, from Compound to eMoney, and nothing matches the granularity and simplicity that Kubera provides with straightforward scenario analysis and adjustable inputs.

Kubera’s scenario toggling are the best in the market

They have an interface to ask AI about your net worth and where to optimize. It has fully exportable data to upload LLM-ready JSON for other chatbots like Gemini and Claude.

The practical advantages stack up. The interface is clean and intuitive, especially for spreadsheet users. You can generate clean reports for mortgage lenders' initial underwriting. It supports multi-user access, including advisors. And it stores critical documents like wills, trusts, and other legal documents.

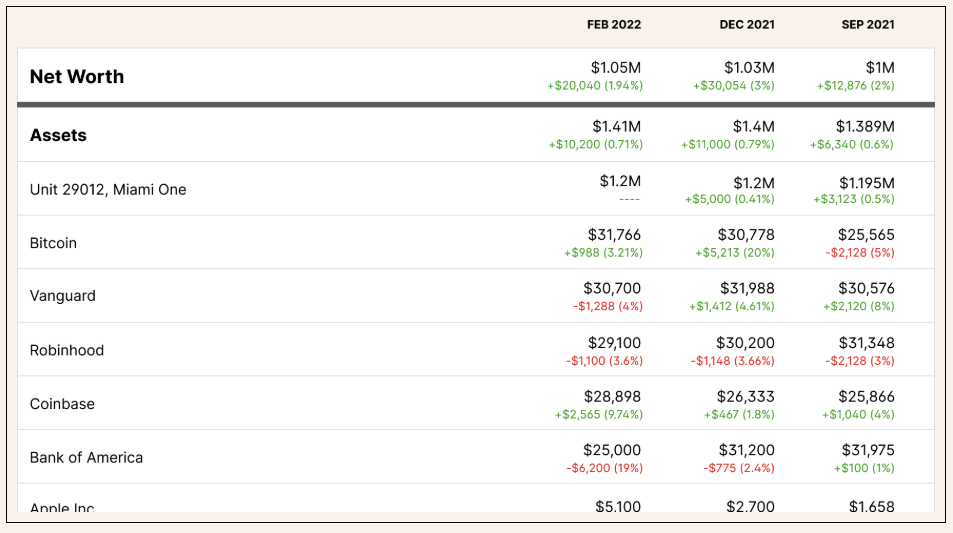

Kubera’s Recap lets you see which assets changed the most each week / month / quarter

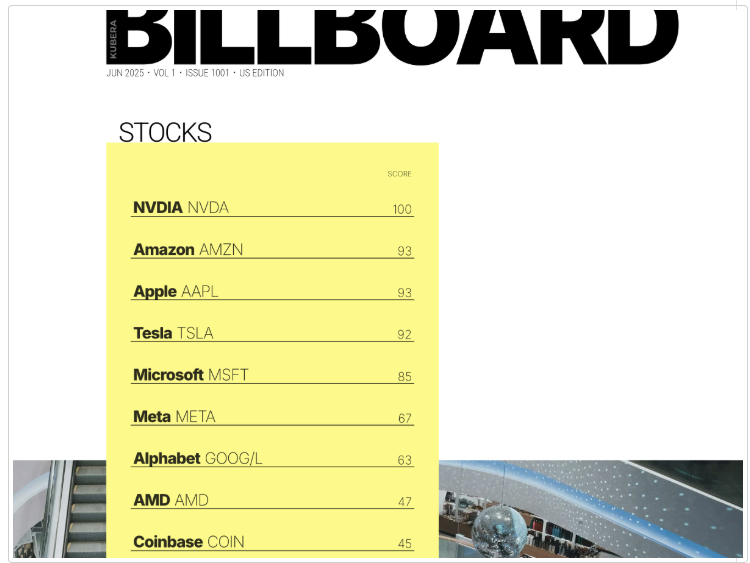

The other recent feature is The Billboard, which ranks stocks, funds, crypto, banks, brokers, and exchanges in real-time based on subscriber usage. There is also a percentile calculator to compare your net worth to others on the platform.

Move aside Billboard Top 40, there’s another Kubera Billboard in town

What sets Kubera apart is what it doesn't do. It doesn't attempt to offer overly general tax filing service, trust services, or try to be your everything platform. At $249/year, it's focused purely on being the best possible dashboard for complex financial situations.

Like Maslow's Hierarchy, the journey through personal finance tools leads to self-actualization. You start with basic needs - tracking spending and finding leaks with budget trackers. You progress through psychological needs - understanding your broader financial picture via money managers. You reach for self-actualization through all-in-one wealth platforms. But true financial self-actualization comes from accepting that you need the best tools for each job, unified by a single clear view of your wealth - the net worth dashboard. The peak is about seeing everything clearly so you can make better choices about what you actually need.